Despite Weaker Data, GBP Led Gains Wednesday

The British economy has been in the spotlight lately as a never-ending cycle of bad news continues to filter through. Yesterday was no different, with GDP missing expectations coming in at -0.3% below the 0.0 expected. This miss was a shock, as many had been forecasting growth.

Production showed the most significant decline losing 1.8%. Manufacturing in transport and pharmaceuticals lost the most by sector. ONS is another factor to consider with long-term staff shortages. Currently, 2.5 million people are unable to work due to illness, a record high.

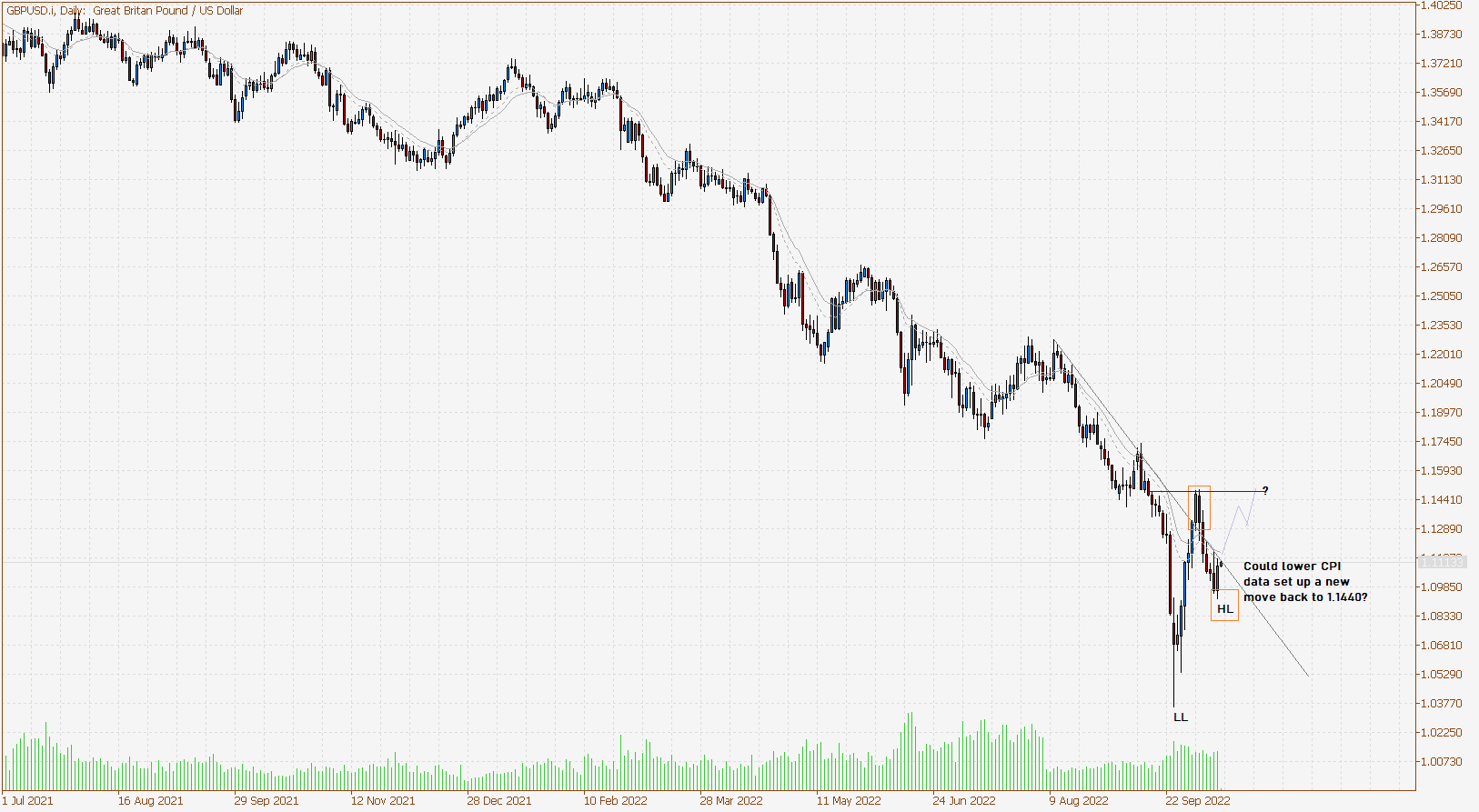

This all comes off the back of the flash crash we saw on the GBP several weeks ago after pressure hit pension funds as collateral requirements increased, causing a mass of selling. The sell-off saw the GBPUSD hit record lows, and the GBPJPY shed over 7% in two days. At the peak of the crash, the BOE stepped in and supported the GBP with Gilt purchases.

Intervention quickly calmed the market, and we saw the GBP pull back all of the flash crash to the USD and JPY. Recently worries reemerged after BOE comments suggested support could be removed, and pension funds had to get themselves sorted out. This message was mixed on Wednesday as reports suggested BOE was going to continue its support.

Fed minutes came out this morning and didn’t tell us anything we didn’t already know. Due to this, we didn’t see any fireworks in previous releases. FX pairs were relatively flat at the end of the US session, but the GBP led the gains continuing Wednesday’s rally after reports the BOE will continue to support it after Friday. The GBP also shook off the weaker GDP data, closing 1.23% higher, while the FTSE dropped 0.86%.

This takes us to this week’s 2nd key data event US CPI. This evening local time, 11:30 pm AEDT M/M and Y/Y CPI data will be released. The expectation is for Y/Y to fall to 8.1% and M/M to increase to 0.2%. If we see shocks to the upside, we would expect the USD to make a charge and, in turn, knock the GBP lower. If we see lower-than-expected data on both fronts, we will be looking for the GBPUSD to continue its move higher and possibly confirm the HL and possibly confirm a break of the fast trend. This could set up a new test of 1.1440.

We like to hear from you, so please feel free to drop us a comment. We also run weekly webinars with guest analysts.

Please subscribe to our Youtube channel and to our newsletter to stay up to date.

* ຂໍ້ມູນທີ່ສະຫນອງໃຫ້ຢູ່ໃນຫນ້ານີ້ສະແດງຄວາມຄິດເຫັນຂອງຜູ້ຂຽນແລະບໍ່ຈໍາເປັນຕ້ອງສະທ້ອນຄວາມຄິດເຫັນຂອງ Eightcap ແລະບໍ່ໄດ້ຮັບການຮັບຮອງໂດຍ Eightcap.

ບຸກຄົນໃດໆທີ່ສະແດງຂໍ້ມູນທີ່ນໍາສະເຫນີຢູ່ໃນຫນ້ານີ້ເຮັດພຽງແຕ່ຢູ່ໃນຄວາມສ່ຽງຂອງຕົນເອງ. ບໍ່ມີຕົວແທນ ຫຼືການຮັບປະກັນ. ໂດຍບໍ່ຄໍານຶງເຖິງຄວາມຖືກຕ້ອງຫຼືຄົບຖ້ວນຂອງຂໍ້ມູນນີ້, ການຄົ້ນຄວ້າໃດໆທີ່ດໍາເນີນບໍ່ໄດ້ຄໍານຶງເຖິງຈຸດປະສົງການລົງທຶນສະເພາະ. ສະຖານະການທາງດ້ານການເງິນ ແລະຄວາມຕ້ອງການຂອງບຸກຄົນຜູ້ທີ່ອາດຈະໄດ້ຮັບຂໍ້ມູນດັ່ງກ່າວ.

ການຊື້ຂາຍ margin ມີຄວາມສ່ຽງສູງແລະອາດຈະບໍ່ເຫມາະສົມສໍາລັບນັກລົງທຶນທັງຫມົດ. ທ່ານຄວນພິຈາລະນາຈຸດປະສົງ. ທ່ານຄວນພິຈາລະນາສະຖານະການທາງດ້ານການເງິນ, ຄວາມຕ້ອງການແລະລະດັບປະສົບການຂອງທ່ານຢ່າງລະມັດລະວັງກ່ອນທີ່ຈະເຂົ້າໄປໃນການເຮັດທຸລະກໍາຂອບກັບ Eightcap ແລະຂໍຄໍາແນະນໍາຈາກທີ່ປຶກສາອິດສະຫຼະຖ້າຈໍາເປັນ.